Thursday, September 25, 2008

I woke up today feeling slightly tired and lethargic. I don't know why but I suddenly feel like I should stay at home and just lie in bed, wasting the day away. I suddenlt have the urge to read Homer's Iliad. Well, I can't explain my lack of enthusiasm on the tasks that I've set myself to do today. I mean, who wouldn't be enthusiastic in decrypting tons (22 files to be exact) of C codes that are so messed up and which lack proper code-comments. Going through them is a bitch because I have no idea what some of his defined function do! If these files are like year-one lab source codes, I won't be complaining at all. But these files are freaking long, with 1000+ lines on the average, per file (maximum I saw was 3000+ -- gulps). Arghhh!

I think today will not be a fruitful day. Shucks! This hopeless feeling sucks. I'm starting to feel that I might not be able to complete my FYP. Boohoo!

Labels: FYP, random thoughts

Monday, September 15, 2008

Employees of Lehman Brothers in Asia were nervously waiting to hear their fate on Monday as the loss-making U.S. investment bank stared at potential collapse.

Asia, where Lehman employs about 3,000 staff excluding the India back office, has proved a sweet spot for the U.S. bank as it made inroads into new markets in the region.

'The situation is quite fluid. We haven't heard anything from New York,' a Lehman executive in Singapore, who asked not to be identified due to the sensitivitiy of the situation, told Reuters by telephone.

'I guess we'll have to wait for the marching orders.'

The Wall Street bank had expanded aggressively in Asia in the last two years, ramping up foreign exchange and investment banking operations in Singapore, Hong

Kong and Mumbai.

It was also planning a bigger presence in China where it recently advised Aluminum Corp of China (Chinalco), which teamed up with Alcoa, on its $14 billion purchase of a stake in Rio Tinto.

For many employees, communication early on Monday was made more difficult because of a holiday in Hong Kong and Tokyo -- the bank's larger offices in Asia.

'Everyone is anxious about what is going to happen,' said another Lehman staffer in Singapore by telephone, adding management had circulated notes to staff last week in the face of growing employee concern and impatience.

At Lehman's Singapore office at the downtown Suntec Tower, only a trickle of staff arrived for work, dodging reporters' questions.

At a nearby coffee bar, two Lehman staffers said they had been called at 6.00 a.m. (2200 GMT Sunday) to be at work at 7.00 a.m.

Asked whether it was business as usual, a Lehman trader contacted by telephone told Reuters: 'What business is there? There's nothing to do. All I've heard is what's being reported on the news.'

Uncertainty also prevailed in Australia, where Lehman entered markets last year through the acquisition of local brokerage Grange Securities for about A$120 million ($98 million).

Earlier this year, the company moved to a new office tower in Sydney's central business district to accommodate its expanded team.

'The negotiations are still ongoing ... basically we don't know where we stand,' said one of the bank's Sydney-based employees. 'Say, for example, there was a filing for Chapter 11, where would that leave all of us ... probably we stand behind other creditors.

'The only thing we could do here is just sit until we hear something more definitive. And almost certainly that would have to happen, I would have thought, before New York opens.'

Michelle Sprod, a Lehman spokeswoman in Sydney, said the firm was declining any comment.

MERRILL SALE

The seismic shakeup in the U.S. financial system could also see Bank of America buying Merrill Lynch & Co Inc

A Temasek spokesman declined to comment on reports that Merrill could be sold.

Merrill Lynch spokesperson in Sydney, Danielle Mapes, said: 'We're not commenting at this stage'.

Last month, Temasek said it saw value in banking stocks in the United States and Britain and could invest more if an opportunity arose.

The Government of Singapore Investment Corp (GIC), the bigger of the city-state's two sovereign funds, had also bought significant stakes in UBS and Citigroup.

Source: forbes.com

And to think that Merrill Lynch has been giving recruitment talks in NUS (the next one will be in two days time), how bleak can the near future get?

Labels: random thoughts

Monday, September 1, 2008

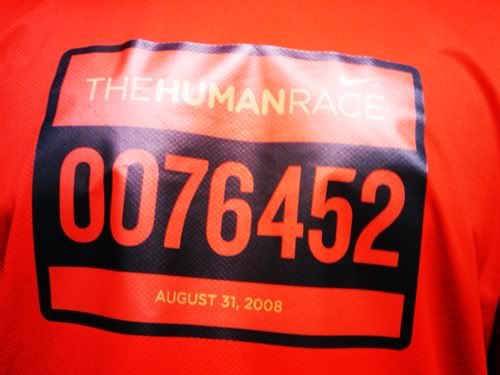

After a long break from running long distance, I must say I've nearly gotten back my running form. There were times along the race where it is so so tempting to stop and take a breather. But I know that if I did, I would find it even more tiring to continue running. And the race markers were at the 2km, 6km and 9km - hence, it's kinda difficult to gauge where the mid-point of the race was.

The point where the tiredness kicked it was somewhere after Central shopping centre (about 7+km?). I nearly wanted to stop but I decided to push on to the next drink stop. Towards the end, especially after the 9km marker, the lure of walking was so strong! But it was kind of stupid to stop then because I've already ran like 9km without stopping and there was only several hundred meters left! So I ran - till I reached the finishing like at 58 mins flat! haha..

I broke my personal best of 1hr 4mins (but that was an all-terrain run which included a torturous 2km beach trail). Overall, I think the run was well organized. I had fun and most importantly, it's for a good cause.

I met a few people at the race whom I know. For most part of the event, I ran a lonely race. haha.. Well, here are some pictures from the race. Sadly, I have no pictures of myself. LOL.

P/s: The results are just in - I'm ranked 1000-ish for the race. I must say, there were some really fast kids out there! LOL. Geez.. I'm getting old.